GARY MUNSON

FINANCIAL GUIDE

Contact Us

Gary Munson Trillion Mortgage

garymunson.com

801-560-2999

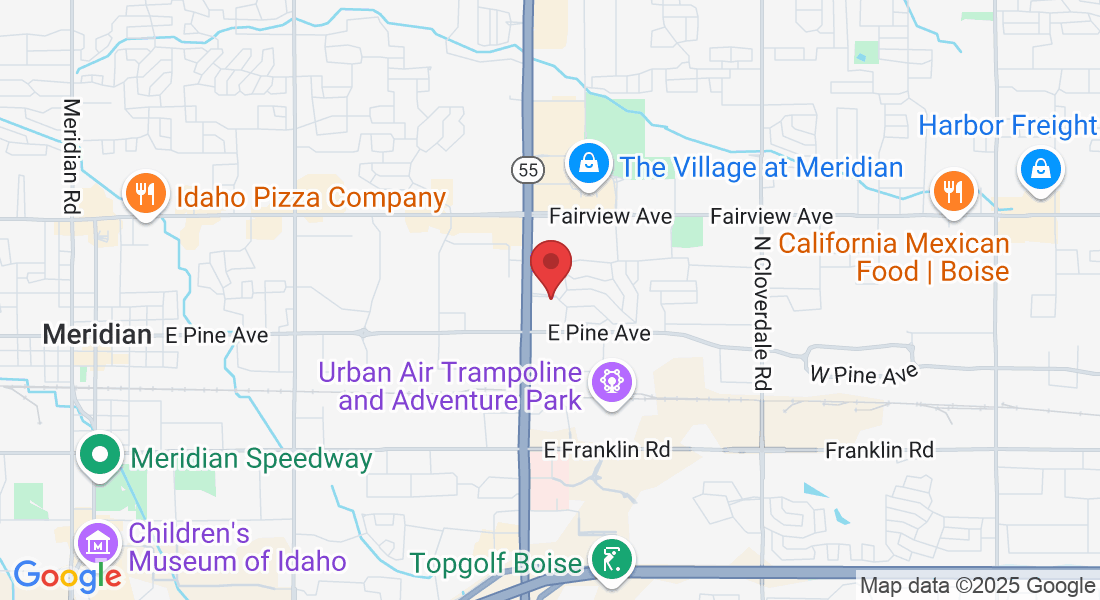

5636 Green Street, Murray, Utah, 84107

Listen To What Customers Say…

Because It’s Customers That Matter Most.

WHO WE ARE

The Most Trusted and Successful Mortgage Brokerage in Utah

We’re from Salt Lake, we live here and we do business here. Our kids go to school here and we are building our businesses here. Your experience in purchasing your new home, or selling your beloved abode is very important to us. Our mission is to make it as hassle-free and profitable as possible.

We want to help you achieve your Real Estate goals, and establish your family's future with your real estate sales and purchases.

We are here to advise you and give you the benefit of our 20 years of expertise. Understanding our lifestyles here in Utah, we pride ourselves on serving our local community and providing the most balanced and effective consults.

Call us and find out for yourself.

Mortgage and Affordability Calculators

We have designed a system to pinpoint exactly what type of mortgage financing you are eligible for, and what you can comfortably afford.

We work with you on identifying the various factors as far as income, credit scores, monthly expenses and projected increases.

We enter all of our data into our proprietary Mortgage and Affordability Calculators, and can show you the details of what type of loan best fits your needs, and which properties are available in those categories. Then we begin the process of selecting properties for review and consideration.

Guidelines: Finding and Closing On Your Dream Home in 30 Days!

Chris and his wife found their dream home, and they were very organized in their purchase process. If you stick with our guidelines here, you too can be in your new home, keys in hand, within 30 days - maybe less!

Day 1-3: Negotiate the Offer

(Once the offer is made, negotiations can take several days. Be sure to establish: Purchase price, Closing Date and Moving Date).

Day 4: Home Inspection

(With a Signed offer in hand, request the Inspection of your New Potential Home).

Day 7-10: Finalize Purchase Contract

(After Home Inspection is completed, get a final Purchase Contract agreed upon).

Day 10 - 14: Apply for Mortgage Loan and Order Home Appraisal

(Apply for your loan and establish the value of your new home with the loan provider).

Day 14-20: Get Full Loan Approval and Final Conditions

(Once your loan is approved, you can proceed to closing dates and Move In!).

Day 21-28: Get Loan Documents, Sign and Send Money...Here's YOUR Keys

This can go REALLY FAST...could be 2-3 days. Get the movers ready!

Learn How To Find The Right Loan Officer For Your Purchase or Refinance.

Get Advice From Our Team.

Call Or Contact Us Today 801-560-2999

"Gary Munson is quick to respond, keeps me updated on important dates and milestones and is honest and straightforward. I appreciate his professionalism, reliability and his amazing can-do attitude. I would give him 100 stars if Facebook would allow me."

~Trevor L.

Read Some Persistent Mortgage Myths :

“The COMPANY is more important than my loan officer.”

The local bank or mortgage company wants you to feel good about their brand, but the facts are, talented loan officers with the experience you NEED on your side don't stay with banks. They go where they can deliver a less expensive loan with better rates in a shorter timeline. Banks aren't built to deliver that, and the great loan officers will only put up with that for so long.

“You can get a better deal from a Bank.”

Logic tells us to start at the bank, that is where the money is. If you are in the bank, look at the size of the building, the fancy lobby, the many employees walking around. This is overhead that is expensive. They pass those costs on to you with extra fees and higher rates that take more money from your pocket. Find a mortgage broker, they will shop 20 lenders for you to find the best loan that can close the fastest at the lowest rate and costs you can qualify for. The bank only has one option...them.

“Credit Unions are less expensive”

Credit Unions specialize in low rate car loans, and we think that since the car loan was cheap, the mortgage rates must be also. Not true. Credit Unions almost always charge you an "origination fee" which is straight profit. Brokers can find you the same rate without that extra 1% origination fee...and that can we $3,000-$4,000 extra you pay. Refuse, find a mortgage broker and keep the $4k in your account.

Call Us Now For An Initial Price/Payment Session

801-560-2999

Frequently Asked Questions

Does My Credit Score Affect My Ability to Buy?

Yes, essentially your Credit Score will affect your chances and types of traditional home loans that will be options for you. There are other types of unconventional loan services that you can qualify for, if your credit score is not optimal, but they do come with higher interest rates and more stringent parameters.

How Much Should I Plan on for a Down Payment?

Most home buyers, especially first-timers, need to plan on between 5% and 20% for their down payment. This will vary and depend on your loan provider's requirements and loan contract. The type and length of the loan also affect this percentage.

Helping Families Achieve Their Dreams Since 1994

Easy To Find & Convenient Hours

Navigation

© Copyright 2021. Gary Munson Trillion Mortgage. All rights reserved.